|

There are usually three types of billings made by the company to its clients as follows:

1. Downpayment = refers to the first billing upon signing of the contract and it is to be recouped for every progress billing made. Contracts usually provides 20% downpayment as an assurance that the contract will be paid.

2. Progress Billing = refers to billings for the accomplishment made during the duration of the construction.

3. Retention Billing = refers to deduction from the progress billing to ensure that future repair works will be done and that the contract will be completed by the contractor. Contracts usually provides 10% retention fee. Upon completion and turn-over of the contract, the accumulated retention fee will be billed and paid.

For construction companies, the VAT is remitted on every collection made. Therefore, downpayment is subject to VAT even if there's no revenue is recognized yet. The system can be setup based on this regulation.

Step-by-step instructions:

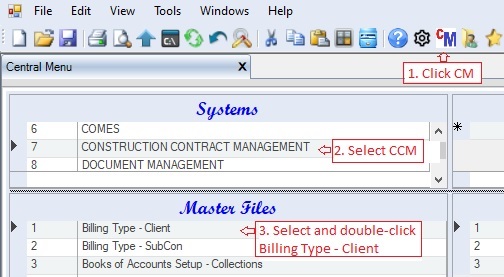

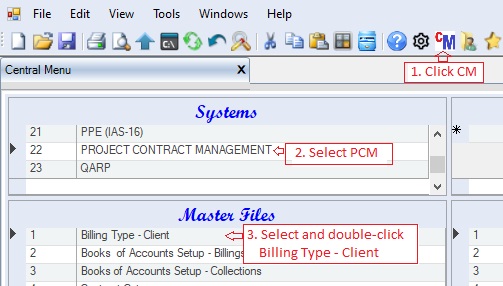

1. Open Cenral Menu. Your Central Menu maybe different from the screenshot below as each user can have different menu and access rights.

2. Select Systems->Contractuion Contract Management or Systems->Project Contract Management. This master file is also accessible from other systems. An update here will also be reflected on the other systems.

3. Double-click Master Files -> Billing Type - Client. You will be redirected to Construction Contracts tab window.

For Construction Contract Management System:

For Project Contract Management System:

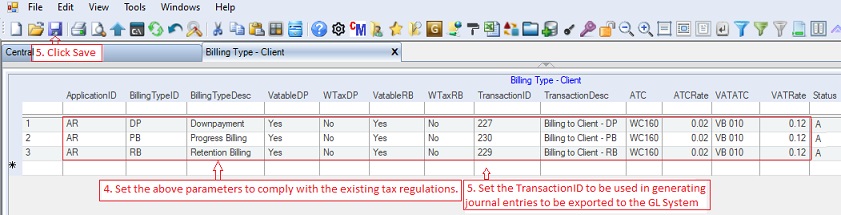

4. Set the parameters based on the existing tax regulations so that the system will compute VAT and EWT properly

5. Set the TrasactionID to be used in generating journal entries to be exported to the GL System.

6. Click Save.

The above setup will result to the following journal entries:

Given data:

Contract Amount: 112.00

Downpayment: 20%

Accomplishment: 100%

1st Progress Billing: 50%

2nd Progress Billing: 50%

Retention Fee: 10%

To simplify the entry, the Final VAT for government project is not taken into account but the system is capable to compute this tax.

|

Account Title

|

Debit

|

Credit

|

|

1. Collection of Downpayment (20%)

|

|

CIB*

|

22.40

|

|

|

Ouput VAT payable

|

|

2.40

|

|

Advances from Clients

|

|

20.00

|

|

2. Progress Billing 50%

|

|

A/R

|

39.20

|

|

|

Retention Receivables

|

5.60

|

|

|

Deferred Output VAT

|

1.20

|

|

|

Advances from Clients

|

10.00

|

|

|

Deferred Ouput VAT

|

|

6.00

|

|

Construction Revenue

|

|

50.00

|

|

3. Collection of Progress Billing (50%)

|

|

CIB

|

38.20

|

|

|

CWT

|

1.00

|

|

|

Deferred Output VAT

|

4.20

|

|

|

A/R

|

|

39.20

|

|

Ouput VAT payable

|

|

4.20

|

|

4. Progress Billing 100%

|

|

A/R

|

39.20

|

|

|

Retention Receivables

|

5.60

|

|

|

Deferred Output VAT

|

1.20

|

|

|

Advances from Clients

|

10.00

|

|

|

Deferred Ouput VAT

|

|

6.00

|

|

Construction Revenue

|

|

50.00

|

|

5. Collection of Progress Billing (100%)

|

|

CIB

|

38.20

|

|

|

CWT

|

1.00

|

|

|

Deferred Output VAT

|

4.20

|

|

|

A/R

|

|

39.20

|

|

Ouput VAT payable

|

|

4.20

|

|

6. Collection of Retention Fee

|

|

CIB

|

11.20

|

|

|

Deferred Output VAT

|

1.20

|

|

|

Retention Receivable

|

|

11.20

|

|

Ouput VAT payable

|

|

1.20

|

|

*If the client deducted 2% on Downpayment, set the value of DP for WTaxDP to Yes. A debit to CWT will be added in the journal entry. The CWT for Progress Billing will also be adjusted accordingly.

|

Data Definition:

Database Table Name: cm_BillingTypeAR

Primary Key: BillingTypeID

|

Column Name

|

Sample Value

|

Description

|

|

ApplicationID

|

AR

|

Don't change the default value of AR.

|

|

BillingType

|

DP

|

Type of Billing

|

|

BillingTypeDesc

|

Downpayment

|

Description of the BillintType

|

|

VatableDP

|

Y

|

Yes, if the downpayment is subject to VAT. As of this writing, tax regulation states that DP is subject to VAT

|

|

WTaxDP

|

N

|

We simple put N. Since the payee/client controls this if he/she will deduct withholding tax.

|

|

VatableRB

|

Y

|

Yes, if the Retention Billing is subject to VAT. As of this writing, tax regulation states that RB is subject to VAT upon collection

|

|

WTaxRB

|

N

|

We simple put N. Since the payee/client controls this if he/she will deduct withholding tax.

|

|

TransactionID

|

227

|

The proforma journal entries to be used when creating journal entries

|

|

TransactionDesc

|

DP Billing

|

Description of the TransactionID

|

|

ATC

|

WC160

|

Select from the dropdownlist. But this is usually has the value of WC160

|

|

ATCRate

|

2%

|

Withholding tax rate

|

|

VATATC

|

VB010

|

VAT apha tax code

|

|

VATRate

|

12%

|

VAT rate

|

|

Status

|

A

|

A=Active; I=InActive. You can mark inactive vendor category to remove them from the lookup table.

|

|

Createdby, DateCreated, Modifiedby, DateModified

|

|

These columns are called audit trails. Their values are auto-generated. One who created or modified the app. It is assumed that the current user is the one who created or modified the record.

|

|