|

The Taxpayer master file contains all the list of taxpayers. The taxpayers information here are saved separately from the company master file. The company master file allows special characters such as ", + & " while the bir validation modules does not allow these special characters during dat file validation..

It contains three related tables as follows:

1. Taxpayer - names and information about the taxpayers.

2. Tax Types - types of taxes based on the company COR. Entries here are used to generate Reminders or deadlines.

3. Signatories - information for the signatories of each bir return.

Step-by-step instructions:

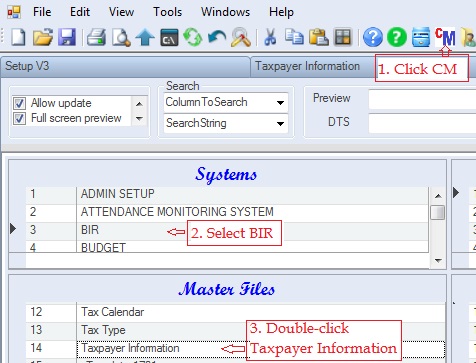

1. Click Cemtral Menu.

2. Select Systems -> BIR

3. Double-click Master Files -> Taxpayer Information You will be redirected to Taxpayer Information tab window.

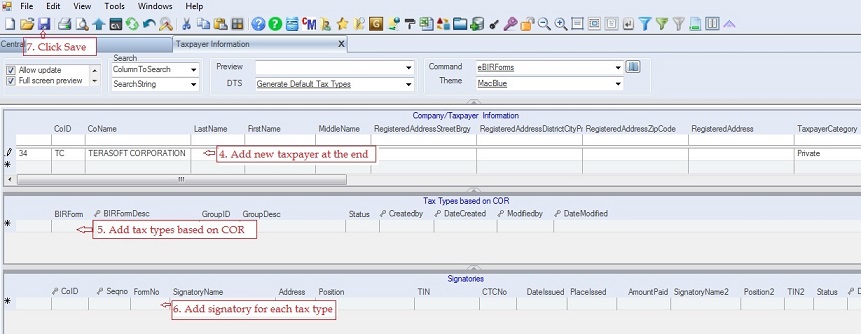

4. Add new taxpayer information. Do not include special characters.

5. Add tax types of the new taxpayer.

6. Add signatories for each bir return filed by the taxpayer. You need this when printing returns like 2316 and 2307

7. Click Save when done.

|