|

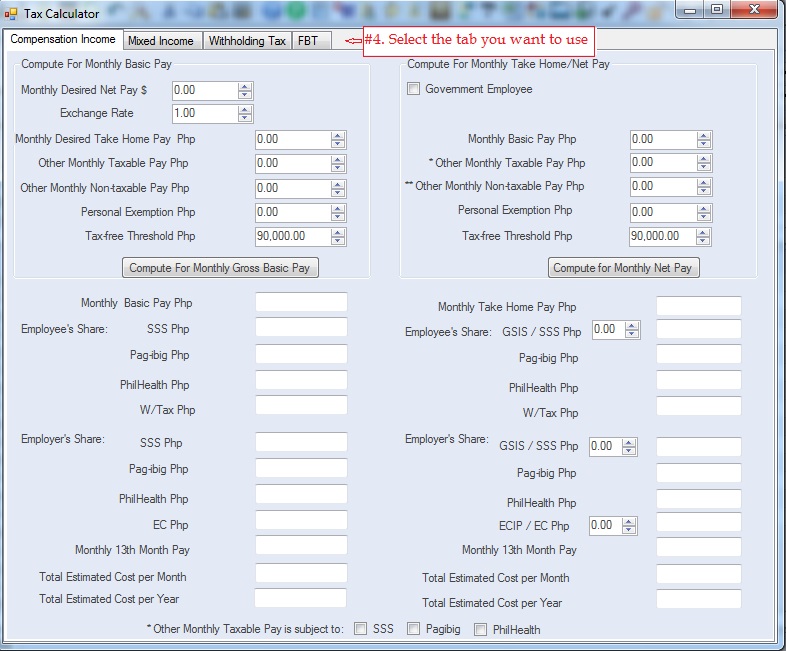

The system is shipped with 4 tax calcutors as follows::

1. Employee Compensation Income: From the desired net pay, it will compute the gross pay, social premium contributions, withholding tax.etc.

2. Mixed Income Tax Earner: This computes for the income tax for compensation income and business income of an individual.

3. Withholding Taxes: From the desired net amount, it will compute the gross amount, vat, final vat and withholding tax.

4. FBT: This computes the gross-up value and the ftb amount.

Step-by-step instructions:

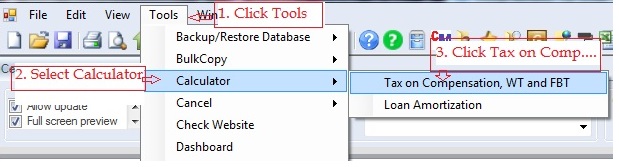

1. Click Tools.

2. Select Calculator

3. Double-click Tax on Compensation, WT and FBT. You will be redirected to Tax Calculator window.

4. Select the calculator you want to use.

Below Screenshot showing the Withholding Tax calculator

|