|

This modules contains the list of tax deadlines required to be filed by the taxpayer(s). It is recommended to update this calender on a yearly basis preferrably before the year begins. This is linked to the tax types table of the Taxpayer Inforamtion master file. A reminder table will show the Return to be filed when the due date is near. Only one tax calender master file is used for all the taxpayers registered into this system

Step-by-step instructions:

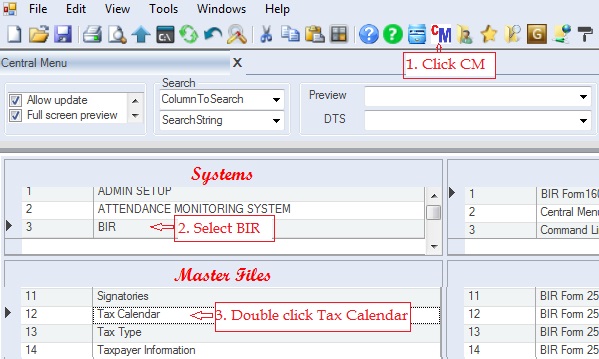

1. Click Cemtral Menu.

2. Select Systems -> BIR

3. Double-click Master Files -> Tax Calendar You will be redirected to Tax Calender tab window.

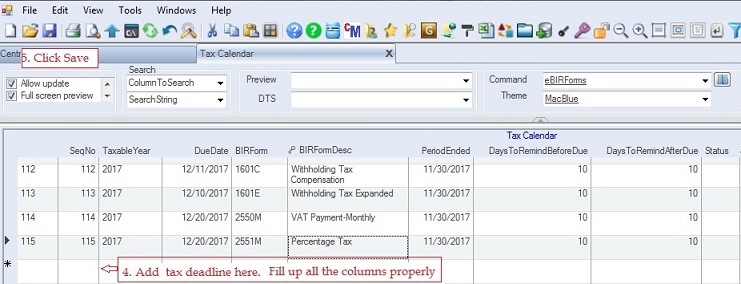

4. Add new tax deadline at the bottom. Fill-up all the necessary columns as follows.

Taxable Year - refers to the year of the bir return

Due Date - refers to the due that the the return should be filed

BIR Form - refers to the return form.

DaysToRemindBeforeDue - refers to number of days before the due date that the reminder will be shown.

DaysToRemindAfterDue - refers to the number of days after the due date that the reminder will still be shown. If you wish not to show, just enter zero.

5. Click Save when done.

This tax calendar will be used by all the taxpayers registered here in the bir system.

|