|

This module generates monthly 1601C and it is integrated with the Payroll System. It can retrieve the needed data from the payroll transactions. You can also use it without the Payroll system, just encode the data manually or use copy/paste if you have excel copy of your 1601C data.

Step-by-step instructions:

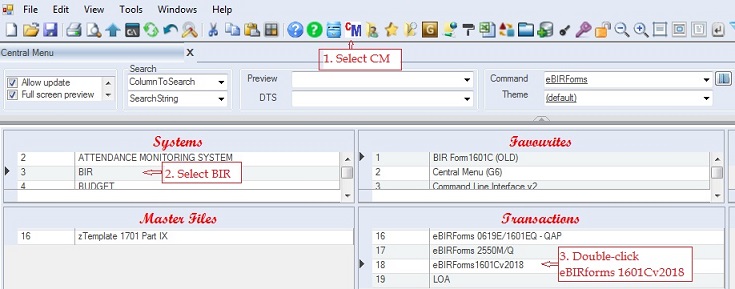

1. Click Cemtral Menu.

2. Select Systems -> BIR

3. Double-click Transactions ->eBIRForms1601Cv2018. You will be redirected to eBIRForms1601Cv2018 tab window.

To retrieve data from the payroll system

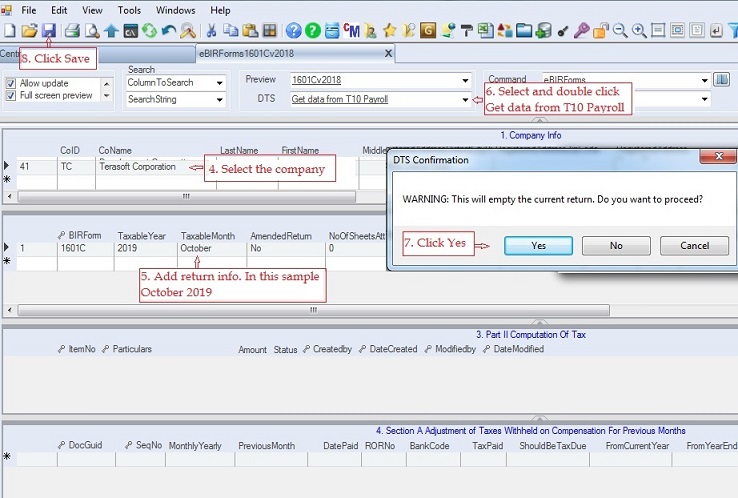

4. Select the company under the Company grid. If the company is not yet encoded, enter the company information using the Taxpayer Information master file. BIR does not allow special characters such as , ' + &*, avoid using these characters when entering data for BIR modules. The main Company Master File allows special character and so to avoid these special characters, a new database table named bir_Company is created.

5. Add BIR Return Info. Fill-up all the necessary columns .

6. Select and double-click DTS -> Get data from T10 Payroll

7. Click Yes to retrieve the data. Review the generated data. If you are not using the Payroll system, on the #6 select Generate Part I (empty) and then you can manually encode the data .

8. Click Save.

To print 1601C:

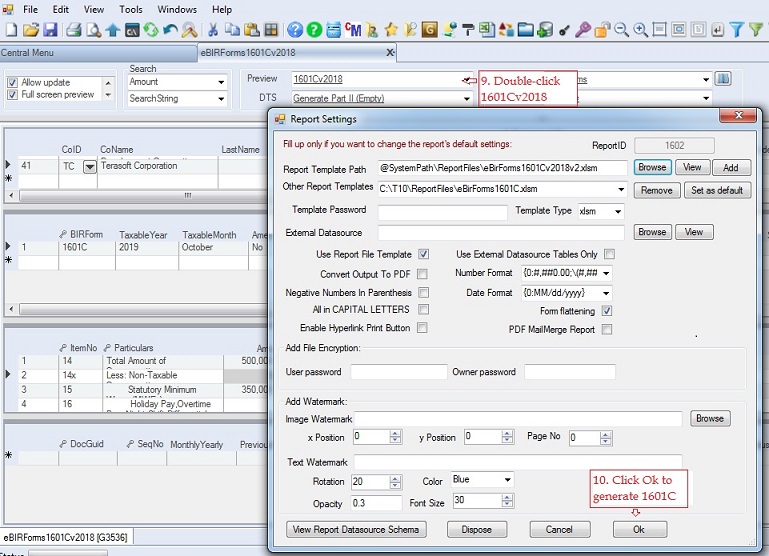

9. Double-click Preview -> 1601C. The Report Settings pop-up windown will appear.

10. Click Ok, the 1601C will be generated and exported to Excel..

11. Excel apps will be executed showing the generated 1601C. You can now print and save this file.

|