|

The Chart Of Accounts master file is the core of your journal entries and subsidiary ledgers. You must build it properly. Though revision can be done afterwards but it's always recommended to build it right the first time. The system is shipped with default chart of accounts but you must build it based on your company requirements.

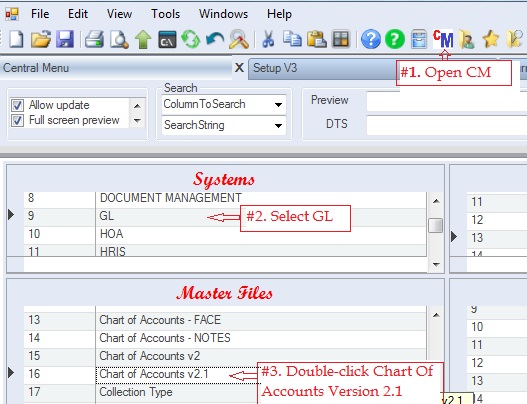

Step-by-step instructions:

1. Click Cenral Menu. Your Central Menu maybe different from the screenshot below as each user can have different menu and access rights.

2. Select System->GL

3. Double-click Master Files -> Chart Of Accounts - Version 2.1. You will be redirected to Chart Of Accounts - V2.1 tab window. Updated to version 3.0 to include CoID column.

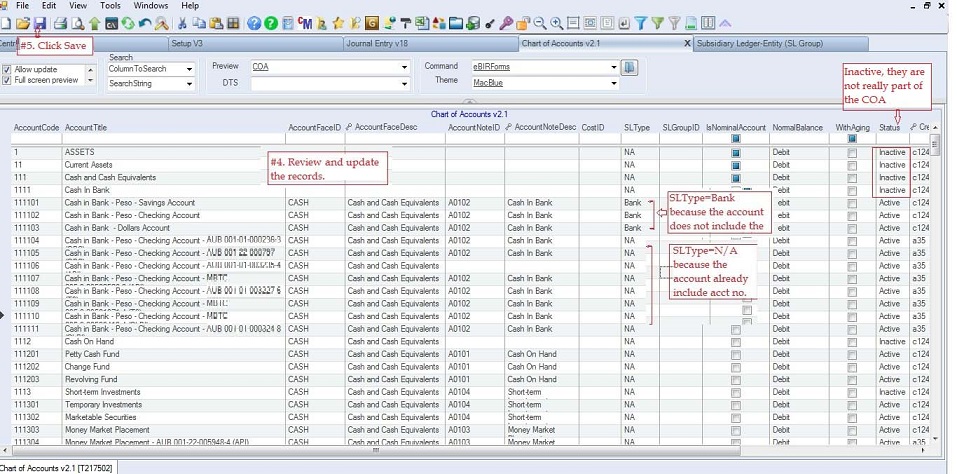

4. Review and update the records. The following columns must be filled-up properly

•CoID refers to company ID that the account code is assigned to. Leave blank if the account code will be used by all the companies or if you have only one company installed. This is usually for CIB accounts where each company has their own code.

•AccountCode refers to the code number, it's alphanumeric. It's recommended to use numeric only for easy encoding of data. Do not include DeptID and ProjectID in the AccountCode since the GL system is already designed to handle this requirement on a separate column.

•AccountDesc refers to the description that will be shown when printing journal entries.

•AccountDefinition refers to full definition of the account. Usually based on your accounting manual.

•AccountNoteID refers to the ID number of the AccountNote.

•AccountNotesDesc refers to the description that will be shown on the Notes to FS.

•AccountFaceID refers to the ID number that the Notes is linked in the FS

•AccountFaceDesc refers to the description to be shown in the FS. You can edit existing description to conform with your audited fs.

•CostID refers to the Cost grouping if you are using the Project Contract Management System.

•SLType refers to the type of SL that the account is required to have. There are three types of SL: 1) Bank for bank accounts, 2) Entity for clients, vendors and employees, and 3) Contract for project contract. Put N/A if it's not required or you don't know yet what type of SL an account should have..

If the account contains SLType, you will be required to enter the value of the corresponding SL type. Example: CIB accounts may require bank account number to be entered on your journal entry. However, if you included in your chart of account the bank account number, you must put N/A on the SLType since that specific chart of account is already defined to that particular bank account. Ex: CIB-BDO-SA#0041500000xx

•SLGroupID refers to the SL grouping that the account belongs to. This is only optional if you want grouping other than the FACE group.

•IsNominalAccount. Put Check if the account is nominal which will be closed to Retained Earnings.

•NormalBalance. Assets and Revenue accounts usually have Debit balances, while Liabilities, Equity and Expenses have Credit balances. Accumulated Depreciation accounts should be marked as having Debit normal balance because they are contra-asset accounts and in the presentation of Notes to FS these contra accounts are reported in negative format. The Trial Balances (TB) presents debit amounts as positive and credit as negative; however, in the Notes to FS report these TB amounts are presented in their normal balances for better presentation.

•WithAging. Leave it unchecked as this is already depreciated.

•Status. A=Active; I=Inactive. Accounts marked Inactive will not be shown on the lookup table. So if you want an account not be used anymore in the journal entry, mark it Inactive.

5. Click Save. You can update this file from time to time.

|