|

The Transaction Proforma Entries master file contains the journal entries that will be generated for the accounting tranaction selected by the user. This is intended to facilitate the creation of journal entries as the system will generate the journal entries based on the tranaction id. The default values under Transaction Type Deafaul Proforma Entries master file will be merged with the transaction proforma entries. If the two have the same target value, the transaction proforma entries will prevail over the default entry.

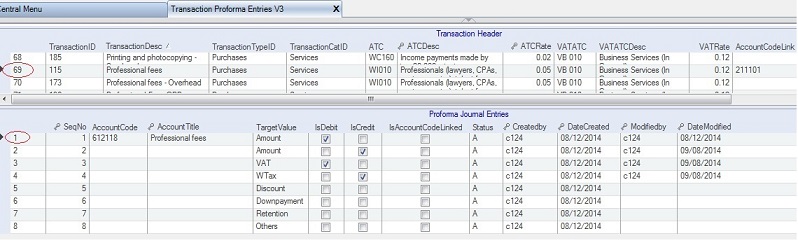

The system can handle up to eight rows of journal entries for each transaction proforma entry. This is best explained with an example as follows:

Explanation of the above proforma entries as follows:

For Transaction Header under Row 69. See encircle above:

|

Column

|

Value

|

Description

|

|

AccountCode

|

612118

|

The account code of Professional fees based on COA

|

|

AccountTitle

|

Pof fee

|

The account title of Professional fees based on COA

|

|

TargetValue

|

Amount

|

The amount to be used (Invoice Amount, net of VAT)

|

|

IsDebit

|

Checked

|

Debit account

|

|

IsCredit

|

Unchecked

|

This is subject to 5% WT

|

|

IsAccountCodeLinked

|

|

This is depreciated. Leave it blank

|

|

Status

|

A

|

A=Active, I=Inactive

|

For Proforma Journal Entries under Row 1. See encricle above:

|

Column

|

Value

|

Description

|

|

TransactionID

|

115

|

The ID to be used in linking with transaction tables

|

|

TransactionTypeID

|

Purchases

|

This is a purchase transaction

|

|

TransactionCatID

|

Services

|

This is a purchase of service transaction for VAT purposes

|

|

ATC

|

WI010

|

ATC for reporting EWT purposes

|

|

ATC

|

5%

|

This is subject to 5% WT

|

|

VATATC

|

VB 010

|

ATC for VAT reporting purposes

|

|

VATRate

|

12%

|

This is subject to 12% VAT

|

|

AccountCode

|

|

This is depreciated. You can leave this blank

|

|

Status

|

A

|

A=Active, I=Inactive

|

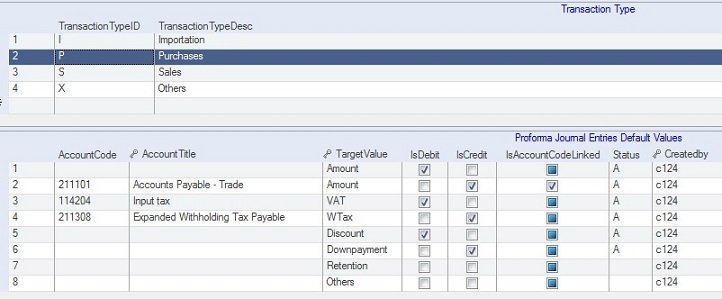

You wll notice that only one Row 1 has been filled up because this entry will be merged with the default entries on Proforma Journal Entry Default Value under Purchases account to complete the journal entries. See below sample of default value on purchases. So when the two merged, the following entries will be made:

Dr. Professional Fees

Dr. Input Tax

Cr. A/P-Trade

Cr. EWT

Screenshot of Proforma Journal Entries Default Value which will be merged to complete the journal entries.

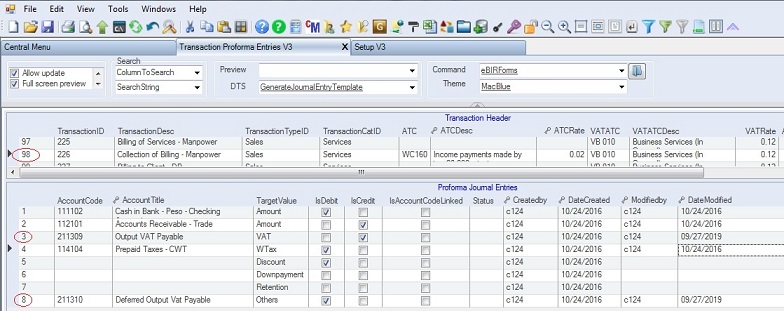

NOTE; You can also fill up the rows 2, 3, and 4 with the same or different values as seen above, however, the transaction proforma entries will prevail over the default values during merging. See example Row 98 encircle below.

In some cases, VAT payable are recognized only upon collection. Upon billing a deferred vat payable is setup and upon collection this account will be debited with the same amount as the recognized VAT payable. Thereby, two accounts will be used for the Vat amount. Under the above proforma entries, the VAT can only handle one account which is either a debit or credit entry. Fortunately we can use the last row (Row 8) to serve as contra Vat entry that any amount debited or credited in the VAT amount will be offset with an opposite entry of the same amount.

Example of this type of transactions: Collections of Billing - Manpower under Row 98 encircle below:

The entry in Row 8: 21310-Deferred Ouput Vat Payable (Row 8 encircle above) will serve as an opposite entry against 211309-Ouput Vat Payable (Row 3 encircle above).

The above sample proforma journal entry is a complete journal entry and does not need default values because the Dr, Cr, VAT and WTax are also provided.

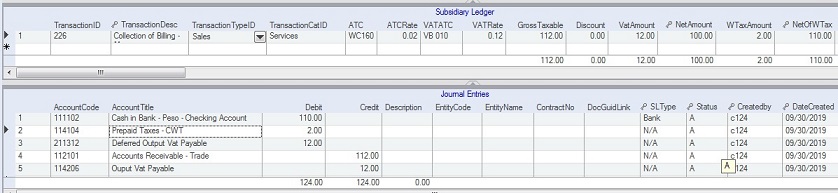

Screenshot below shows the generated journal entries based on the proforma TransactionID above and the figures were taken from the Subsidiary Ledger grid. You will notice that the VAT amount has now opposite Deferred Output Vat payable debit entry of 12.00 as shown below:

Steps by steps instructions:

1. Open Central Menu

2. Select Systems -> GL

3. Double-click Master File -> Transaction Pro-forma Entry v3. You will be redirected to its tab window. Updated to version 4 which include CoID (optional only). Fill-up CoID if the proforma entry will be used exclusively by one company. Leave it blank, if it will be used by all companies or if only one company is installed.

4. Add or update Transaction Header and Proforma Journal Entries grid tables as described above.

|