|

This module is used to enter collections made by the company for services renders.

Step-by-step instructions:

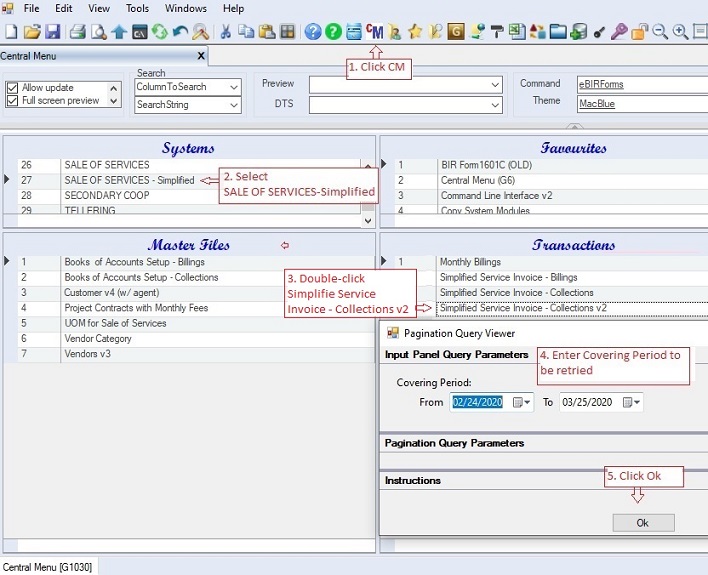

1. Open Cenral Menu. Your Central Menu maybe different from the screenshot below as each user can have different menu and access rights.

2. Select Systems -> SALES OF SERVICES - Simplified

3. Double-click Transactions -> Simplified Service Invoice - Collections. You will be redirected to Collections tab window.

4. Enter Covering Period to filter records to be retrieved.

5. Click Ok

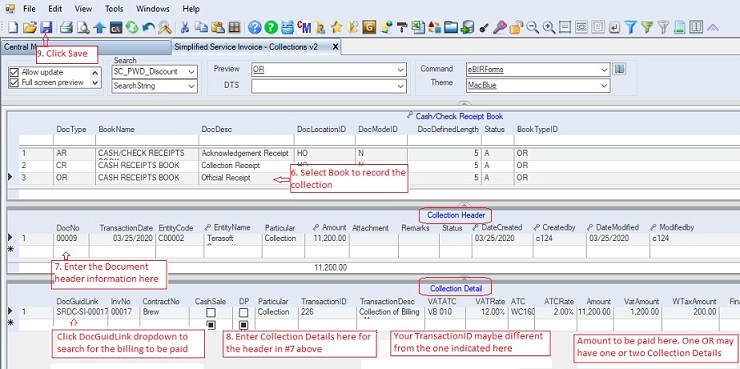

6.Select the book to where the collection will be recorded. Most company uses Official Receipt to record collection. Data on this grid are taken from the master file: Books Of Accounts Setup - Collections.

7. Enter collection header information under the grid table Collection Header grid table. Fill-up all the necessary columns as follows:

•DocType (hidden) - refers the document type where the collection will be recorded. Most company uses OR

•DocNo - refers to document number usually the OR number. You may manually encode the document number.

•TransactionDate refers usually to the date when the record is entered. This is used in filtering data based on covering period under step #4 above.

•EntityCode and EntityName - refers to the client of the company. Update the Customer or Client master file, if the EntityCode is not found.

•Particular - enter descriptive note on this column.

•Amount (formula field) - refers to the total amount based on the Collection Details grid table

•Atachment - you may scan the actual OR and attached the scanned file here.

•Remarks - if you wish to add additional information, you can use this column

•Status. A=Active; I=Inactive.

8. Add the collection details under the Collection Details grid table. Fill-up all the necessary columns as follows:

•DocGuidLink (w/ dropdown) - click the dropdown button to select the billing to be paid. This is necessary to link the collection to a particular billing so that when generating SOA, the system will know what billing where the collection will be applied for.

•InvNo - refers to invoice number, if any where the collection is applicable to. The system does not use this InvNo but instead it uses the DocGuidLink mentioned above.

•ContractNo - this column refers to project contract, if any. This is optional only. You may leave this blank.

•CashSale - check this if there is no billing linked for payment. When generating SOA, all cash sales are considered collected.

•DP - check this if payment received is for downpayment

•Particular - enter any descriptive information here. Ex: 50% collection for FS 2020 audit fee

•TransactionID and TransactionDesc - refer to the proforma journaly entry to be used when system when generating journal entries.

•VAT, VATATC, ATC, ATCRate - these are actually automatically filled up based on the TransactionID. However, you may edit the data if necessary.

•Exempt and ZeroRated - refers to the gross non-taxable collection of billing fees. Columns were moved to the far end as they are not usually used.

•Amount - refers to the gross taxable billing fee .

•Discount - refers to Cash Discount given to the customer. It's recommended that the amount entered under Amount column should be net of discount for simplicity.

•VatAmount, WithTaxAmount - values are automatically computed. However, you may still edit the value

•Final VAT - refers to the final vat deducted by government agency.

•SC_PWD_Discount - refers to SC and PWD discount given to the client, if any.

•All other data are optional.

•Status. A=Active; I=Inactive.

9. Click Save to persist changes made to the database.

|