|

This report is intended to account for all checks prepared for disbursement for a given period. For a good internal control, all used and unused checks should be audited regularly. This is usually done right after the cut-off period in preparing checks as per company policy. If you wish to account for the actual check disbursed, you can use the Check Monitoring reports .

Step-by-step instructions:

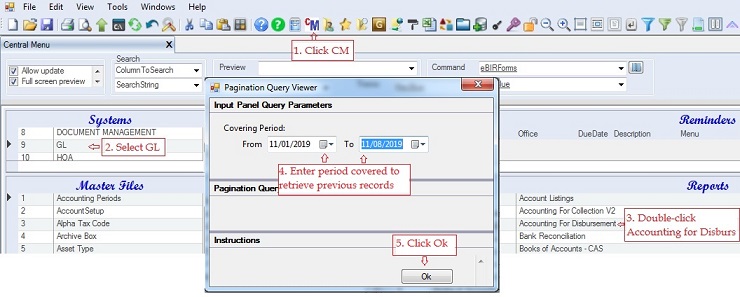

1. Click Cemtral Menu.

2. Select Systems -> GL

3. Double-click Reports -> Accounting for Disbursement. .

4. Enter period covered. This is to filter previously entered transactions based on TransDateFrom column field.

5. Click Ok. You will be redirected to Accounting for Disbursement window tab.

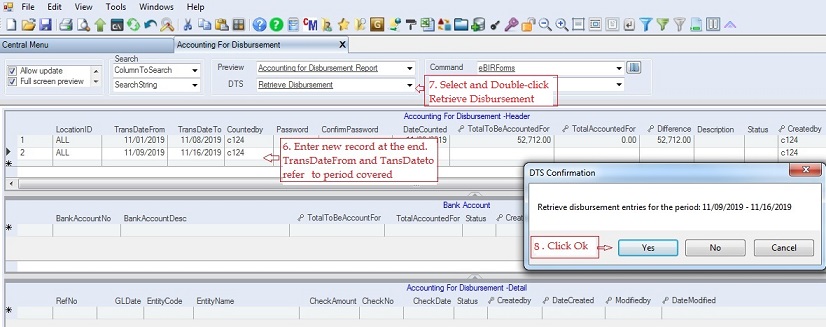

6. Enter new record under the Header table. Fill-up the necessary columns

7. Click DTS - > Retrieve Disbursement

8. Click Ok

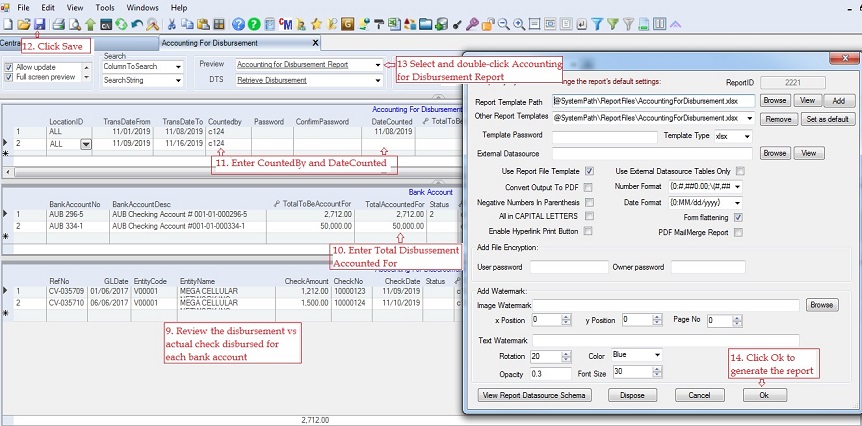

9. Review the retrieved records. Compare them with the actual check disbursed for the given period.

10. Enter the total amount accounted for, this is the actual check disbursed which must to tallied with the retrieved records per bank account.

11. Enter CountedBy and DateCounted to signify review of the records.

12. Click Save

13. Select and double-click Preview -> Accounting for Disbursement Report to print the report

14, Click Ok to generate the report. Sign the report to signify conformity and for future reference.

|