|

The system can automatically create year-end closing entries for all nominal accounts. All accounts having the column IsNominalAccount checked under the Chart Of Accounts master file will be closed to Retained Earnings. Always use December 31 as the GLDate when closing nominal accounts.

Step-by-step instructions:

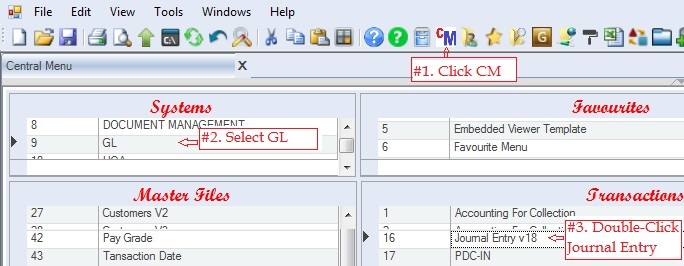

1. Click Cemtral Menu.

2. Select Systems -> GL

3. Double-click Journal Entry v18 (verison 18 is the most recent as of this writing). You will be redirected to Journal Entry tab window.

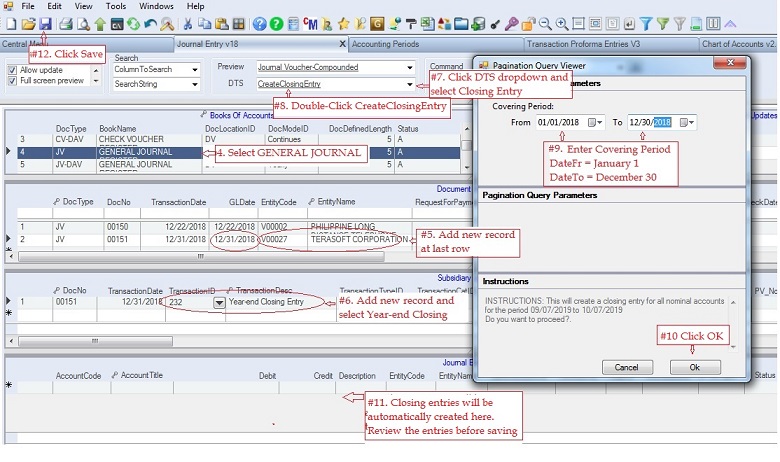

4. Select Books of Accounts -> GENERAL JOURNAL. Closing entries are usually booked under JV.

5. Add new record under Document Header. Fill up all necessary columns. The GLDate must be at year-end or December 31 which is exclusively used for closing entries. When generating reports like TB and FS without closing entries, your covering period will only be up to December 30. The EntityCode and EntityName is the company itself. See encircle items below.

6. Add new record under Subsidiary Ledger record. Fill-up TransactionID (see encircle item below) intended for closing entries.

7. Click DTS dropdown button to show selected options and select CreateClosingEntry option.

8. Double-click CreateClosingEntry the Input Panel Query Parameters pop-up windown will appear.

9. Enter Covering Period: DateFr = January 1 and DateTo = December 30. Enter only December 30 since December 31 is exclusively used for closing entry see #5 above.

10. Click Ok

11. After clicking OK in #10, the closing journal entries will be automatically generated. Review the entries before saving.

12. Click Save.

|