|

This module is integrated with the GL System -> Journal Entries. It can retrieve all the vat transactions recorded under the Subsdiary Ledger table via DTS. You can also use it without the GL system, just encode the data manually or use copy/paste if you have excel copy of your vat entries.

Features:

1. 2550M - Monthly VAT

2. 2550Q - Quarterly VAT

3. List of Sales, Purchases and Importations

4. Dat files generation for eSubmission.

The data exported in this module are saved individually including the TIN, Name and Address of the vendors. Any changes made on the GL Vendor master file are not automatically updated to preserve the actual data exported in the DAT files.

Screenshot below on how to retrieve VAT entries from the GL System:

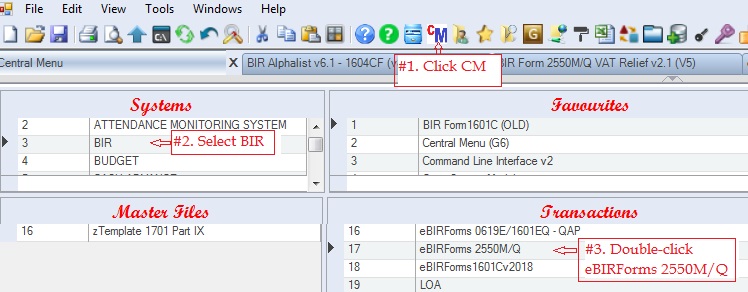

Step-by-step instructions:

1. Click Cemtral Menu.

2. Select Systems -> BIR

3. Double-click Transactions -> eBIRFroms 2550M/Q You will be redirected to eBIRForms 2550M/Q tab window.

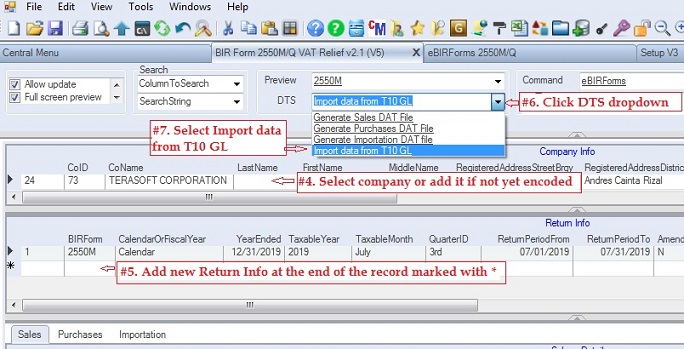

4. Select the company under the Company Info grid. If the company is not yet encoded, enter the company information. BIR does not allow special characters such as , ' + &*, avoid using these characters when entering data for BIR modules. The main Company Master File allows special character and so to avoid these special characters, a new database table named bir_Company is created.

5. Add BIR Return Info. Fill-up all the necessary columns .

If you do not use the T10 GL, you can encode the data manually or use copy/paste if you have excel copy of your VAT entries then skip #6-12.

6. Click DTS dropdown button to show selected options.

7. Select Import data from T10 GL option. To retrieve all VAT entries in the GL system.

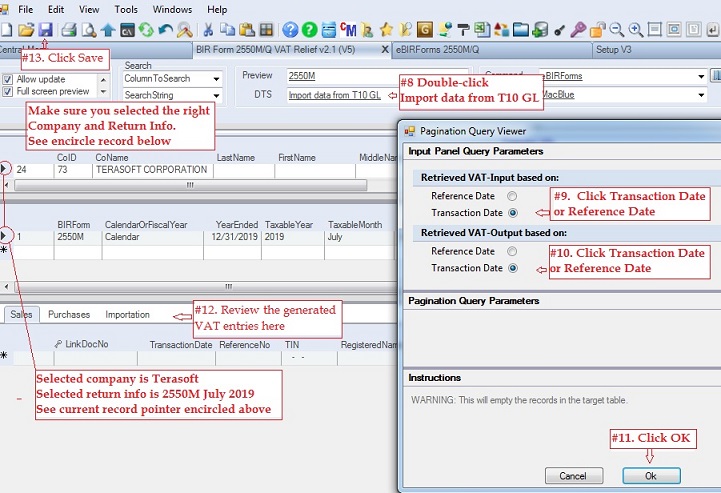

8. Double-click Import data from T10 GL the Input Panel Query Parameters pop-up windown will appear.

Make sure you selected the right company and return info before doing #8 above.

9. Click option Retrieve VAT-Input based on: Transaction Date or Reference Date option. Usually, Transaction Date refers to GLDate and Reference Date refers to the date of the Invoice/OR. The latter option gives you the option to report only those vat entries with supporting documents (Invoice/ORs). Since taxation accounting is not purely on accrual basis.

10. Click option Retrieve VAT-Output based on: Transaction Date or Reference Date option. See #9 above for the difference of these two dates

11. Click Ok

12. After clicking OK in #10, the VAT entries will be retrived based on the currently selected company and return info. Review the entries before saving.

13. Click Save.

To print the Return 2550M/Q.

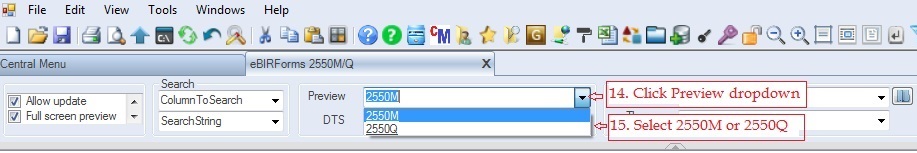

14. Click Preview dropdown

15. Select either 2550M (monthly) or 2550Q (quarterly)

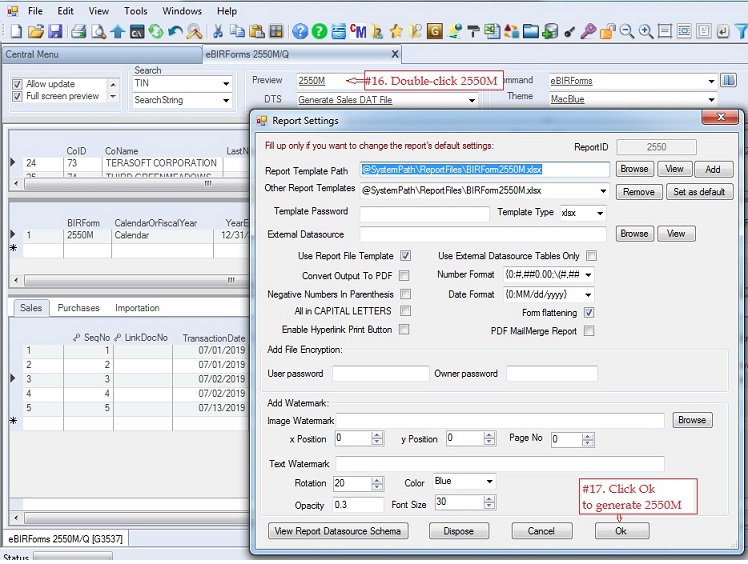

16. Double click 2550M/Q

17. Click Ok, the 2550M/Q will be generated. Review the return before generating the dat files.

The generated return is for reference only as you need to encode the data via efps or ebirforms. The system can generate xml file for eBIRForms user.

To generate the SLSP Dat Files

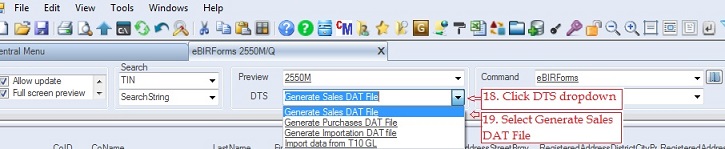

18. Click DTS dropdown button again to show selected options

19. Select Generate Sales DAT File option.

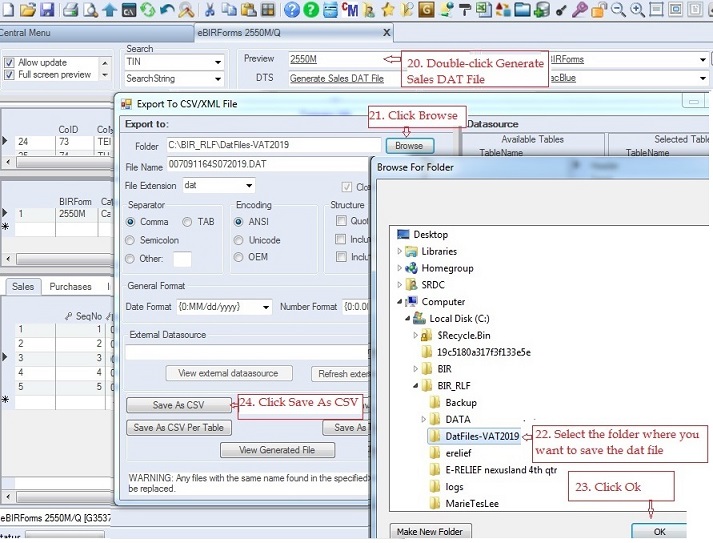

20. Double-click Generate Sales DAT File. Export to CSV/XML file pop-up window will appear

21. Click Browse. A Browse For Folder pop-up window will appear.

22. Select the folder where you want to save the dat file (in the sample below, DatFiles-VAT2019 folder). You may create a descriptive folder like DatFiles-VAT2019. During validation and esubmission this is where you will locate the dat files.

23. Click Ok

24. Click Save As CSV.

25. Message will appear if the dat file is successfully completed. Click Ok

26. Repeat #18 - 25 to generate Purchases and Importation dat files.

You can validate each dat file using BIR validation system. Just remember the folder where you saved the dat files in #22 above. Once validated, you can send them via eSubmission.

|