|

This module is integrated with the GL System -> Journal Entries. It can retrieve all the withholding tax transactions recorded under the Subsdiary Ledger table via DTS. You can also use it without the GL system, just encode the data manually or use copy/paste if you have excel copy of your withholding tax entries.

Features:

1. 0619E with Alphalist of Payees

2. 1601EQ with Alphalist of Payees

3. 2307 in Pdf and Excel format using the new 2307 form.

4. Dat files generation for eSubmission.

The data exported in this module are saved individually including the TIN, Name and Address of the vendors. Any changes made on the GL Vendor master file are not automatically updated to preserve the actual data exported in the DAT files.

Step-by-step instructions:

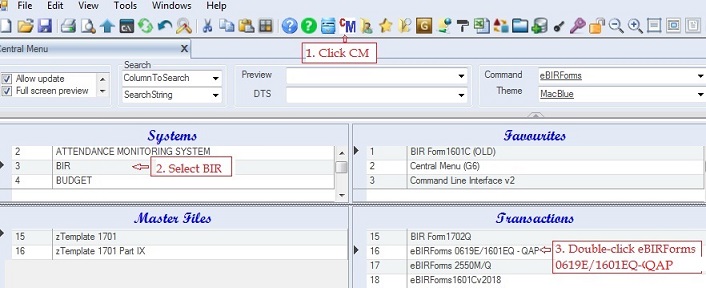

1. Click Cemtral Menu.

2. Select Systems -> BIR

3. Double-click Transactions -> eBIRFroms 0619E/1601EQ-QAP. You will be redirected to QAP tab window.

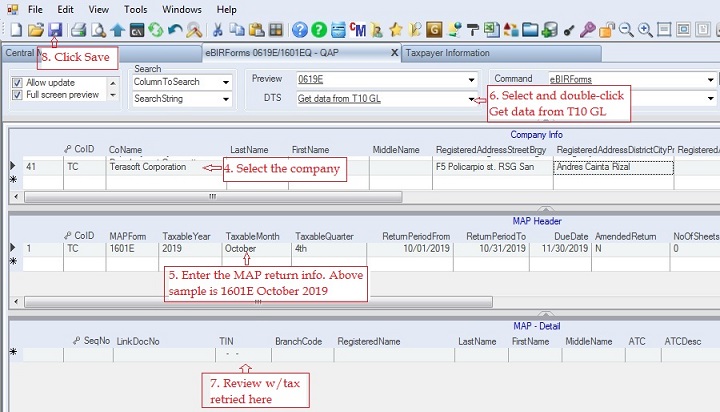

4. Select the company under the Company Info grid. If the company is not yet encoded, goto Taxpayer Information master file and encode the company info there.. Press F5 to refresh.

5. Add BIR Return Info. Fill-up all the necessary columns .

If you do not use the T10 GL, you can encode the data manually or use copy/pase if you have excel copy of the data and skip #6-7 below.

6. Select and double-click Get data from T10 GL option to retrieve all withholdint tax entries in the GL system.

Make sure you selected the right company and return info before doing #6 above.

7. Review the retrieved withholding taxes before saving.

8. Click Save.

To print the Returns 0619E, 1601EQ and 2307

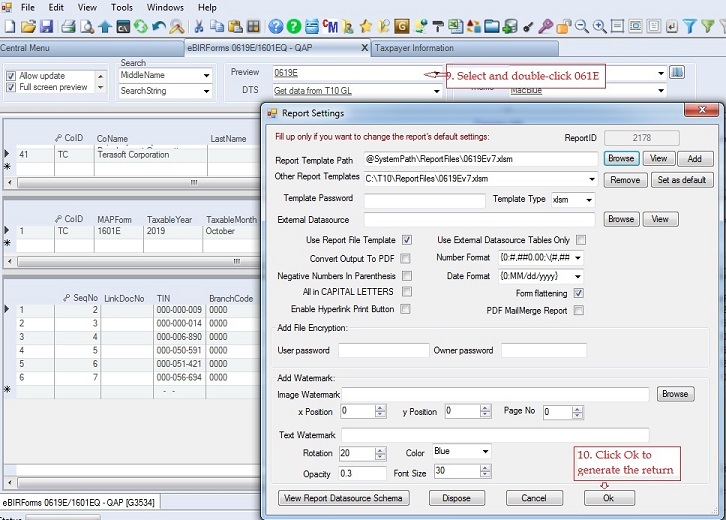

9. Select and double-click Preview -> 0619E.

10. Click Ok, the 1601E will be generated. Review the return before generating the dat files.

To print 2307 based on the given month, repeat #9-10 above but select and double-click 2307 instead of 0619E in #9 above.

If you want to print 2307 on a quarterly basis, you can goto Central Menu and choose Reports -> BIR Form 2307 (based on QAP).

To generate the QAP dat Files:

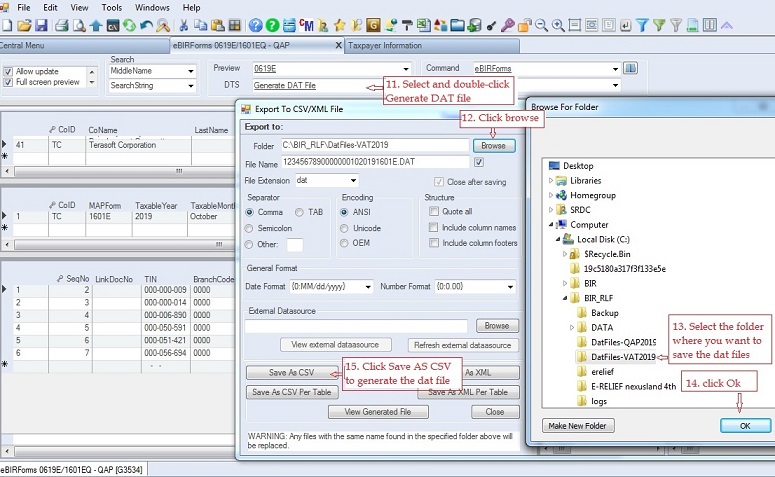

Generation of dat file is on a monthly basis. In this sample October 2019 is the selected month to generate the dat file.

11. Select and double-click DTS -> Generate DAT File. Export to CSV/XML file pop-up window will appear

12. Click Browse. A Browse For Folder pop-up window will appear.

13. Select the folder where you want to save the dat file (in the sample below, DatFiles-QA2019 folder). You may create your own descriptive folder. During validation and esubmission, this is where you will locate the dat files.

14. Click Ok

15. Click Save As CSV.

16. Message will appear if the dat file is successfully completed. If there are errors, correct them and repeat #11-15 above. Click Ok

You can validate each dat file using BIR validation system. Just remember the folder where you saved the dat files in #22 above. Once validated, you can send them via eSubmission.

|